Which of the Following Sources Has the Highest Tax Authority

3 umbrella company I am looking for authoritative sources. The IRS considers only _____ sources to constitute substantial authority for purposes of the IRC SS 6662.

US Constitution Highest source of tax authority.

. E All have the same weight. Subject to a change in the IRC o Temporary provides guidance until final regulations are issued and have. Standard Order of Authorities - As Per Bluebook Rule 14.

The court does not decide many tax cases. Rank the following items from the highest authority to the lowest in the Federal tax law systema. Refer to the tab on secondary sources for more information.

Four states tie for the second-highest statewide rate at 7 percent. A PLR is issued to establish with certainty the federal tax consequences of a particular transaction before the transaction is consummated or before the taxpayers return is filed. Congressional power to enact tax laws US.

Tax source responses can be used more than. Which of the following courts has the highest tax validity. Of the items listed the internal revenue code would have more authority since the code is compiled from the statutes.

Temporary Regulation e. Which of the following sources has the highest tax authority. The Department of Treasury is given the authority to regulate tax law because it is part of the Executive Branch of government and has been granted power to do so by Congress.

Internal Revenue Code d. Authority or primary authority is divided into two types mandatory and persuasive. In formal legal writing the order of authorities refers to the sources which are used to validate claims made by the author of the paper.

Lesson 113 Sources of Tax Law. A bill brief showed eight property tax pieces 10 income tax pieces and seven sales tax pieces. A treasury regulation revenue procedure c internal revenue - Answered by a verified Tax Professional.

C Internal Revenue Code. Lesson 111 Origins of Taxation 359. Constitutions in the following order -.

Court of Federal Claims. California has the highest state-level sales tax rate at 725 percent. Which of the following sources has the highest tax authority.

Administrative authority is tax authority created by the Treasury Department and the Internal Revenue Service IRS. O Final highest authority issued by the Treasury and binding on the IRS. However many tax questions cannot be answered merely by applying the language of the Code and the researcher may be required to consult other sources.

Finally you will be introduced to entity classification for tax purposes. The sources should be arranged according to their order of importance in accordance with Bluebook Rule 14. All have the same weight.

Among the tax provisions were the following. This guide is designed to help you find laws and information on tax law issues. Which of the following has the highest tax validity.

Authority for the tax treatment of an item if the treatment is supported by controlling precedent of a United States Court of Appeals to which the taxpayer has a right of appeal with respect to the item. Or a Secondary Source. Supreme Court of the United States.

Which of the following sources has the highest tax validity. Revenue Ruling Revenue Procedure Regulations Technical - Answered by a verified Tax Professional. When researching federal tax law you may need to review the following.

Within the Department of Treasury the Internal Revenue Service specializes in enforcing the Tax Code and Regulations. Treasury Regulations Overview of general types. Revisions to the property tax revenue neutral rate process.

Lesson 115 Judicial Doctrines 410. Judicial authority is the tax authority created in. Christopher Phelps Certified Public Accountant CPA Category.

Question 9 6 points For each of the following tax sources indicate whether the source is. Which of the following sources has the highest tax validity. Accounting questions and answers.

For example when you do tax research on the tax treatment of a specific transaction you want the highest level of authority when taking a tax position. Internal Revenue Code d. Internal Revenue Code IRC Statutes Foundation for all federal tax authority US.

Internal Revenue Code section e. Federal tax law it does include some information on state and local tax matters as well as some non-US. Lesson 112 Sources of Tax Law.

These primary sources carry a high weight of authority within the tax laws. Indiana Mississippi Rhode Island and Tennessee. Proposed RegulationI have no idea.

The other types of authority are interpretations of the Regulations. Next highest is IRC. Accounting questions and answers.

Question 9 6 points For each of the following tax sources indicate whether the source is Primary Legislative authority Primary Administrative authority Primary Judicial authority. The lowest non-zero state-level sales tax is in Colorado which has a. The Internal Revenue Code is the most authoritative source of federal tax law.

Secondary authority is located in legal encyclopedias jurisprudences and Amerian Law Reports ALR among others. Must have substantial authority for the tax treatment of an item when filed or the last day of the taxable year to. Which of the following sources has the highest tax authority.

If there is a constitutional issue concerning a tax or if there is a split in the Circuits on a particular tax matter the Supreme Court is far more likely to accept the case. The purpose of this guide is to introduce you to a number of useful tax law resources and get you started in the right direction. Which of the following sources has the highest tax authority.

Each authority has its own weight and is deemed more reliable than other authorities. A private letter ruling or PLR is a written statement issued to a taxpayer that interprets and applies tax laws to the taxpayers specific set of facts. 2 In tax law what source has the highest tax authority or reliability.

Then Foreign Tax Treaties. Court of Appeals for the Fifth Circuit. Although it focuses on US.

Which of the following sources has the highest tax validity. Which of the following sources has the highest tax validity. Lesson 114 Sources of Tax Law.

Student Gradebook Exam NEXTf7b93cf124MainCourse. Which of the following types of Regulations has the highest tax validity. Leave a Reply Cancel reply.

4 Ways A Private Limited Is Better Than A Limited Liability Partnership Limited Liability Partnership Private Limited Company Corporate Tax Rate

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

What Is A Form 26as How To Download And Use Form 26as Scripbox

Expat Jobs And Career Ideas Make Money Expats Successful Online Businesses Travel Income Online Business

Half A Dozen Of India S Crypto Exchanges Searched After Alleged Rupee 700m Tax Evasion Detected Sources In 2022 Law Enforcement Agencies Tax Exchange

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Tax Collection More Than Doubles In April In 2021 Business Pages Tax Fiscal Year

Sources Of Us Tax Revenue By Tax Type Tax Foundation

British Tax Authority Seeks Data From Crypto Exchanges In Search Of Tax Evaders Tax Services British Taxes Internal Revenue Service

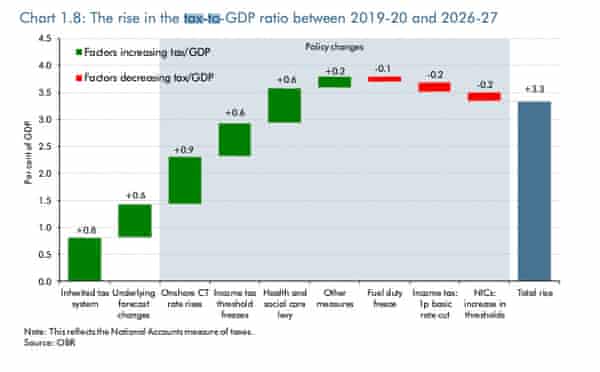

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

What Is Revenue Budget Revenue Receipt Sources Of Tax Revenue

Sources Of Us Tax Revenue By Tax Type Tax Foundation

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

What Is Non Tax Revenue The Financial Express

Tds Rate Applicable On Mf Redemptions By Nris For Ay 2021 22 Mutuals Funds Capital Gain Fund

Mutual Funds Capital Gains Taxation Rules Fy 2018 19 Ay 2019 20 Capital Gains Tax Rates Chart For Nris Mutuals Funds Capital Gain Fund

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.36.18PM-3a2688ba1ec14484a5671edf63fe45be.png)

.png)

Comments

Post a Comment